How much emergency fund should I have? Breaking down how much you should save for emergencies depending on your personal financial situation.

It’s always a good thing to be prepared.

If you have a job interview coming up, you want to be as prepared as possible. That way you are ready for any unexpected questions they may throw at you.

If you are buying a new home, you want to do your research on the neighbourhood to make sure it suits your needs. In addition, you want to purchase home insurance to avoid any thefts or in case there’s a fire.

The same can be said about personal finances—you want to be prepared for the unexpected.

In this post, I will break down how much emergency fund you should have depending on your personal situation.

Let’s jump into an overview of emergency funds.

How Much Emergency Fund Should I Have?

What is An Emergency Fund?

An emergency fund is money you set aside that is only meant to be spent if there is an emergency.

In short, an emergency fund is an accessible amount of money for the unexpected.

If you find yourself in a situation like losing your job, having to pay for a medical emergency, paying for home or car repairs, an emergency fund ensures that you have money available.

Moreover, an emergency fund ensures that you don’t have to go into debt to cover an emergency.

It can also be viewed as insurance for your investment portfolio, because it prevents you from having to withdraw from your investments.

Typically, an emergency fund is held in an easy-to-access savings account so the funds are instantly accessible.

How Much Emergency Fund Should I Have? It Depends On Your Situation

The amount of money you should save largely depends on your personal situation.

For example, if you don’t have a stable job or if your income fluctuates, you need to have a larger emergency fund.

If you have a mortgage on an older house, you will need to set aside more cash for maintenance and repairs.

If you have a car with an expired warranty, you must be prepared for unexpected repairs.

Furthermore, if you have dependents, you likely need to have a larger emergency fund.

Another factor to consider is the state of your personal health. If you live somewhere that does not provide medical coverage, or if you are frequently in need of healthcare, you need to have more emergency funds available.

Basically, the higher your expenses are, the more money you need to save for emergencies.

To get an accurate idea of how much you need to save, try out this fund calculator by RBC Royal Bank.

Most Experts Think 3 to 6 Months Worth Of Expenses

Most experts recommend that you have 3 to 6 months worth of expenses available set aside for an emergency.

So, if you spend $5,000 per month, you need to have at least $15,000 sitting in an accessible account.

Since I can live on $1,500 per month or less, I should have at least $4,500 set aside based on this recommendation.

However, some experts, such as Dave Ramsey, recommend an emergency fund of only $1,000.

Of course, you have to understand that Dave Ramsey’s target market are people who are financially illiterate. Essentially, he keeps his advice as basic as possible so that even a child could understand it. His advice is mainly for people who have mountains of debt.

But I agree with him. It doesn’t make sense for someone with $250,000 worth of debt to save up a $15,000 emergency fund when they are spending thousands on interest each month.

For anyone with an investment portfolio of assets, I agree that keeping only $1,000 for emergencies makes sense.

If you have $1,000 put aside, it should be enough money to cover the beginning of an emergency. As long as you have other liquid assets available, you technically already have an emergency fund.

So, how much emergency fund should you have?

To give you a direct answer, you should have at least 3 to 6 months’ worth of expenses set aside if you don’t have any other liquid assets. You should have up to a year’s worth of expenses depending on your situation.

But if you have no debt and a portfolio of liquid assets, an emergency fund of $1,000 or one month’s worth of expenses should suffice.

Take it from me, I took a year-long mini-retirement to test it out.

The Downside Of Emergency Funds

The reason you don’t want too high of an emergency fund is because of the opportunity cost.

In the words of Ray Dalio:

“I believe cash is and will continue to be trash.” – Ray Dalio via Yahoo Finance

Because of inflation and the unprecedented amount of money being printed to deal with the pandemic, cash is literally losing its value.

And you can already begin to see how inflation is affecting the economy—the price of assets have been skyrocketing over the past year.

Bitcoin, real estate, and stocks have increased in value. Meanwhile, cash has lost its buying power in comparison to these assets.

Cash doesn’t pay dividends like dividend stocks, nor does it experience rapid growth like growth stocks or bitcoin.

Hence why you need to manage your finances like a business.

If you observe how a business manages its cash flow, they keep just enough money to cover operating costs. The rest is invested for growth, paid back to shareholders, or moved to a treasury asset like bitcoin.

I don’t see why personal finances should be managed any different.

Instead of waiting on the sidelines for the stock market to correct, which no one really knows when it will happen, your cash could at least be invested in dividend stocks that will grow faster than inflation.

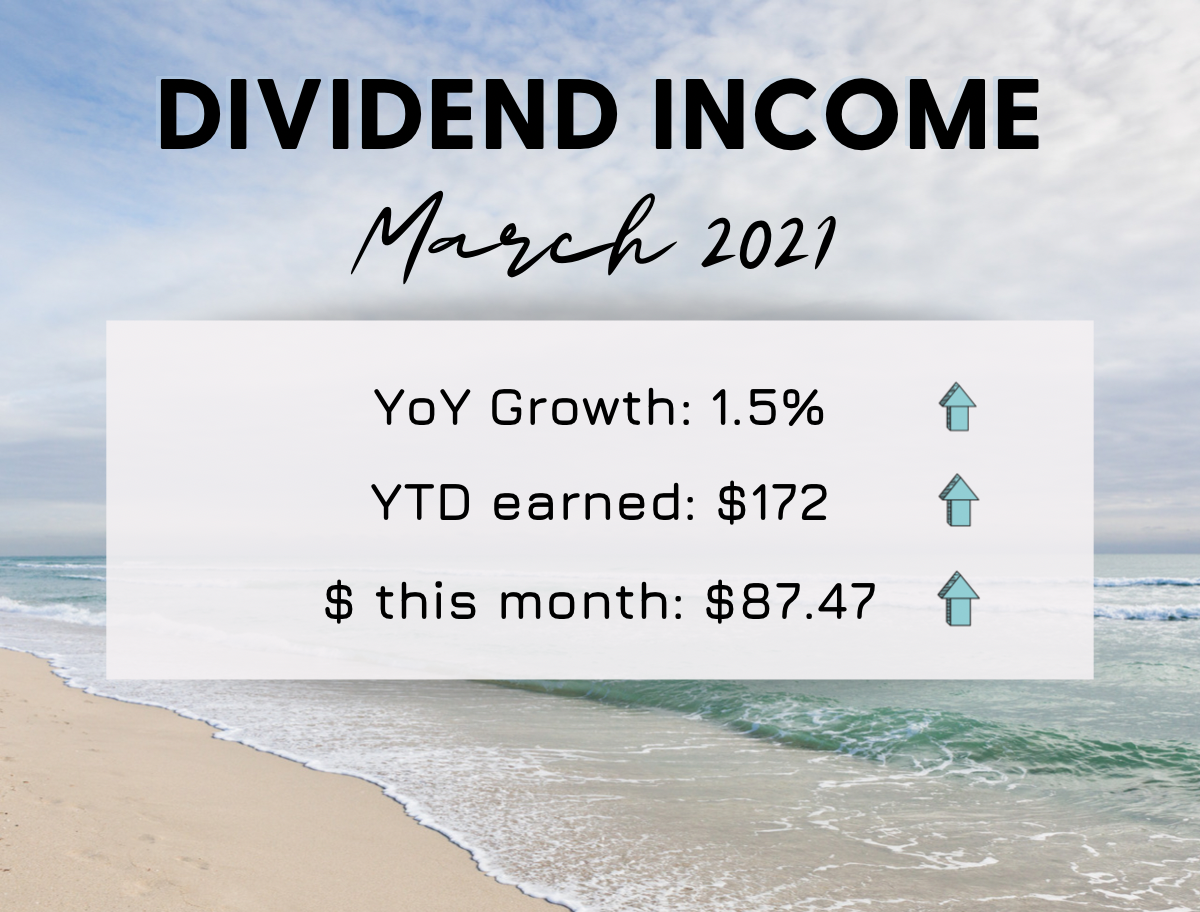

And if you invest enough cash in dividend growth stocks, you can get paid an emergency fund in dividends annually. For example, I earn nearly $700 per year by having my money invested in dividend stocks.

If Your Expenses Are Low, You Don’t Need An Emergency Fund

Personally, I don’t have an emergency fund because I don’t think it’s necessary.

Since my expenses are low, I have a stable job, alternative income streams, and I have an investment portfolio, I don’t need an emergency fund.

I proved this when I took a mini-retirement year off work and paid for it by trading and living off my portfolio.

To provide a more detailed explanation, I can live on less than $1,500 per month.

I don’t own a car or house, so I don’t have any car payments or mortgage payments.

To cover my expenses, I work a high-paying part-time job (from home) that pays me approximately $2,000 per month, even if I only work 15 hours per week. I am extremely fortunate to have this job. I’m not going to go into detail about it, but my job is practically guaranteed for life.

So, even if I work half the time as a normal full-time job, I still have excess money per month.

Plus, I have extra income streams from blogging and investing.

If an emergency ever occurred, I could get my expenses even lower, and I have an investment portfolio that could cover my expenses for a long time. Even if the market corrected by 50%, I would still have enough to cover my expenses for a long time.

For these reasons, I don’t think an emergency fund is necessary when you have low expenses.

In my view, the money is better off in income-generating assets that pay me an emergency fund.

Rather than having an emergency fund, you just need an emergency plan.

How To Save For An Emergency Fund

The best way to save for an emergency fund is to pay yourself first.

To begin, open an easy-to-access savings account. I prefer a high-interest savings account, because it’s easy to transfer the money online in an emergency.

After your savings account is opened, simply transfer a percentage of each paycheque into the savings account.

Repeat this until your desired emergency fund amount is achieved.

Back when savings accounts used to pay interest, I transferred 1% of each pay into a savings account. It doesn’t sound like much, but even doing that for a year or two will build up a $1,000 emergency fund.

Since I’ve stopped holding an emergency fund, I now transfer 1% per pay into bitcoin. It has turned to to be much more lucrative.

How Much Emergency Fund Should I Have? – Final Thoughts

Based on my personal situation, I don’t have any emergency fund because I’m 99% invested in equities.

But if my situation changed, I would keep one month’s worth of expenses in an easy-to-access savings account.

How much should you set aside?

It depends on your personal financial situation. Mainly, it depends on the following factors:

- If you own a house (for maintenance, taxes, repairs, lawyer fees)

- If you own a car (for maintenance and repairs)

- Your health (medical emergencies)

- Job stability (if you work a commission job, if your job is replaceable, or if you could be let go in a down turn)

- If you have dependents

- How high your expenses are

Depending on those factors, most experts agree that you should keep at least 3 to 6 months’ worth of expenses in an emergency fund so you are prepared.

Now I’d like to hear from you. I’m curious to know if you maintain an emergency fund. If you do, how much do you think is an ideal amount to set aside?

Other Personal Finance Articles You Might Enjoy

Pay Yourself First – How To Pay Yourself First

How To Increase Your Net Worth: 4 Steps To Follow And Repeat

How To Become Financially Stable

I am not a licensed investment or tax adviser. All opinions are my own. This post may contain advertisements by Monumetric. This post may also contain internal links, affiliate links to BizBudding, Amazon, Bluehost, and Questrade, links to trusted external sites, and links to RTC social media accounts.

Connect with RTC

Twitter: @Reversethecrush

Pinterest: @reversethecrushblog

Instagram: @reversethecrush_

Facebook: @reversethecrushblog

Email: graham@reversethecrush.com

Jobs With A Lot Of Downtime

Jobs With A Lot Of Downtime